42 what is zero coupon

zero-coupon bond - What is another word for zero-coupon bond? Synonyms ... Here are the synonyms for zero-coupon bond, a list of similar words for zero-coupon bond from our thesaurus that you can use. Noun. a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security. Synonyms. zero coupon bond; For zero coupon bonds? Explained by FAQ Blog What is a zero-coupon bond Mcq? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return.

MC Explains | What is a 'zero-coupon, zero-principal' instrument? According to the gazette notification, "zero coupon zero principal instrument" is an instrument issued by a not-for-profit organisation that will be registered with the social stock exchange...

What is zero coupon

Zero-Coupon CDs: What They Are And How They Work | Bankrate This type of deposit account is called "zero coupon" because "coupon" refers to a periodic interest payment and "zero" indicates that it does not incorporate such payments. How zero-coupon CDs work... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Zero-Coupon Mortgage Definition - Investopedia A zero-coupon mortgage is a long-term commercial mortgage that defers all payments of principal and interest until the maturity of the mortgage. The loan's structuring is as an accrual note,...

What is zero coupon. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. What Is a Zero Coupon Yield Curve? - Smart Capital Mind The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when... Zero Coupon Bonds Explained (With Examples) - Fervent Zero Coupon Bonds, aka "Deep Discount Bonds", or "ZCBs" are bonds (a type of debt instrument) that don't pay any coupons (aka interest). In other words, there is no coupon payment (aka interest payment). They pay a zero coupon. Hence the name, zero coupon bond. The only thing they do pay is the Par (aka "face value") when the bond matures.

Zero-Coupon Certificate of Deposit (CD) Definition - Investopedia A zero-coupon CD is a type of CD that does not pay interest throughout its term. Instead, the investor is compensated by receiving a face value upon maturity that is higher than the instrument's... Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - "Zero Coupon bond" means a bond: - (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005 (b) in respect of which no payment and benefit ... What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... About Zero Coupon Mortgage - Best Option For New Business A Zero coupon mortgage is a long-term business loan that carries over all principal and interest payments until maturity. In this type of mortgage, the interest is rolled back into the principal amount due to the loan being designed as an accrual note.

Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is a derivative contract entered into by two parties. One party makes floating payments which changes according to the future publication of the interest rate index (e.g. LIBOR,... What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... Zero-Coupon Bond: Definition, Formula, Example etc. Zero-Coupon Bond is a debt security where the investors will not get any interest against his invested money but he will get a big discount while purchasing the bond. At the time of maturity, when the investor will go to the liquidation he will receive the full face value amount. Normally, a zero coupon bond has a higher return than the regular ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a type of debt security that provides profit for the investor when it reaches maturity. Unlike traditional bonds, zero-coupon securities don't provide interest payments during the life of the bond. Instead, investors make money on these bonds when they buy them at a deep discount.

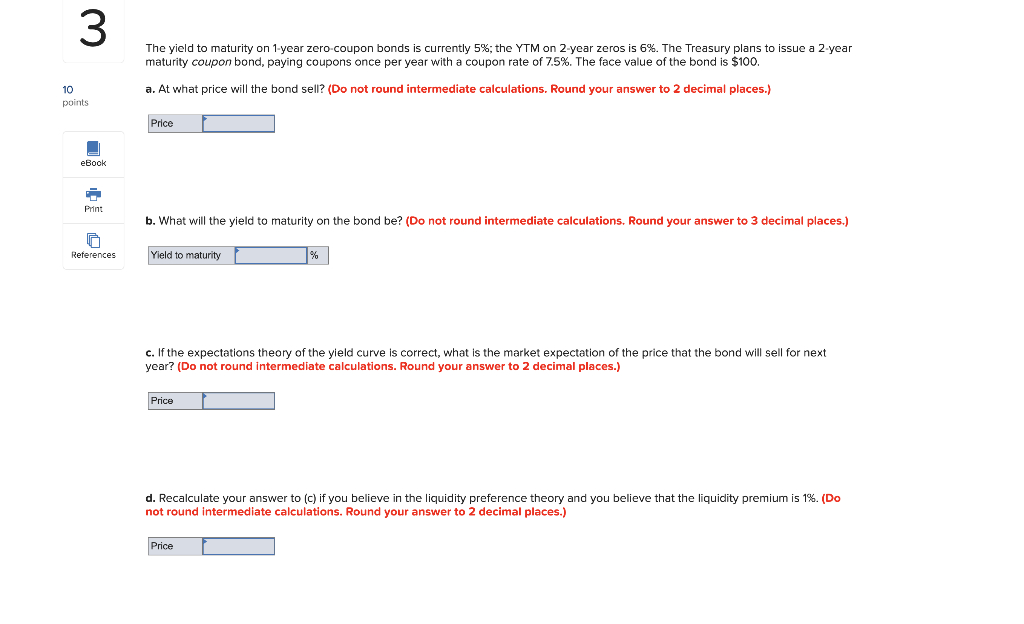

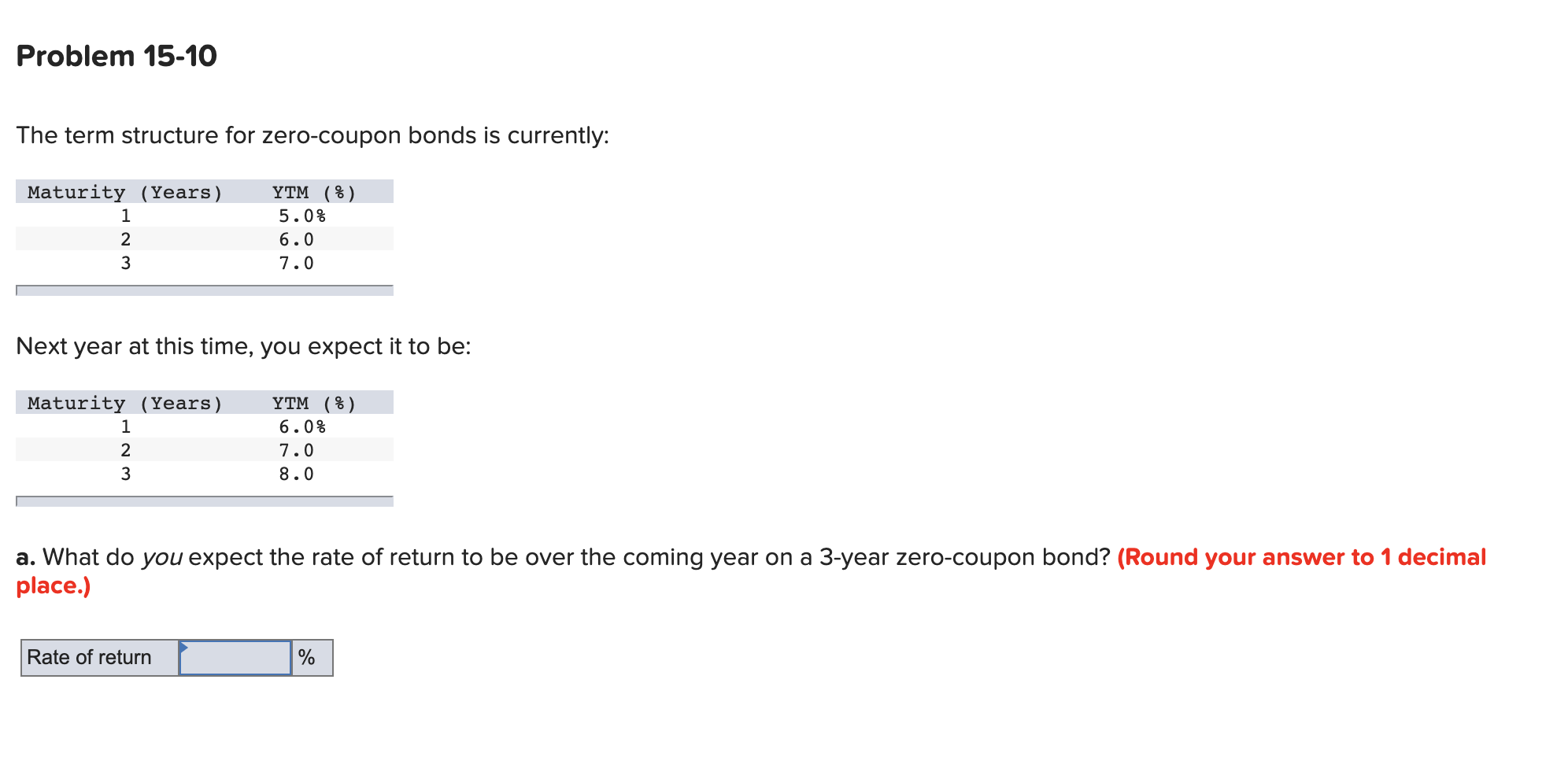

Prices of zero-coupon bonds reveal the following | Chegg.com Prices of zero-coupon bonds reveal the following pattern of forward rates: In addition to the zero-coupon bond, investors also may purchase a 3-year bond making annual payments of $60 with par value $1, 000 a. What is the price of the coupon bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond.

What are Zero-Coupon Bonds? (Characteristics and Examples) Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 "Premium" (Trading Above Par) If Price = 100 "Par" (Trading at Par Value) If Price < 100 "Discount" (Trading Below Par)

Zero-Coupon Mortgage Definition - Investopedia A zero-coupon mortgage is a long-term commercial mortgage that defers all payments of principal and interest until the maturity of the mortgage. The loan's structuring is as an accrual note,...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall.

Zero-Coupon CDs: What They Are And How They Work | Bankrate This type of deposit account is called "zero coupon" because "coupon" refers to a periodic interest payment and "zero" indicates that it does not incorporate such payments. How zero-coupon CDs work...

Post a Comment for "42 what is zero coupon"