39 coupon rate bond formula

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The coupon equivalent rate (CER) is an alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. more Bond Valuation: Calculation, Definition, Formula ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

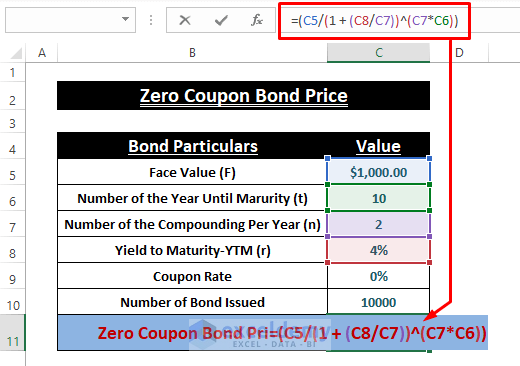

What are Zero-Coupon Bonds? (Characteristics and Examples) Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Coupon rate bond formula

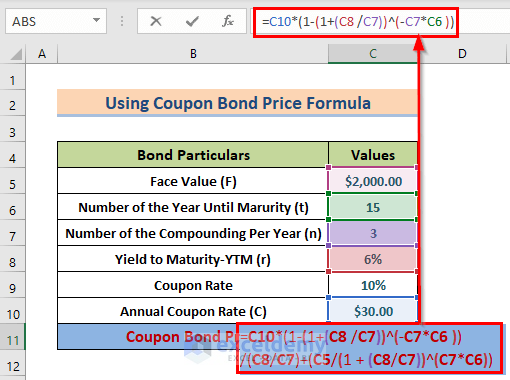

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 Coupon Rate Formula | Simple-Accounting.org For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable for investors than those with lower coupon rates. Bond Yield Rate vs. Coupon Rate: An Overview. Even if the bond price rises or falls in value, the interest ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

Coupon rate bond formula. Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond: What Is a Coupon Rate? - Investment Firms Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Coupon Rate=5%; Bond Price = $970; Solution: Here we must understand that this calculation completely depends on the annual coupon and bond price. Bond Formula | How to Calculate a Bond | Examples with Excel Template Mathematically, the formula for coupon bond is represented as, Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)? How do you calculate the coupon payment of a bond? Coupon payment per period = Face value of the bond × Coupon rate × Coupon period/Total period. Coupon payment per period = $10,000 × 4.5% × 6/12. Coupon payment per period = $225. ... Finally,the formula for determination of the coupon bond calculation is done by adding the present value of all the coupon payments and the par value,as shown ; Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity n = No. of periods till maturity Table of contents What is the Coupon Rate? (Step-by-Step Tutorial) - Wall Street Prep Bond Coupon Rate Formula. The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000.

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond.

Coupon Rate Structure of Bonds — Valuation Academy 3) Floating Rate Bonds have coupon rates that vary based on market interest rate or specific index (we call it reference rate) over the life of the bonds. The common formula to calculate the coupon rate is: new coupon rate = reference rate ± quoted margin.

Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. The coupon rate is the amount of interest the bondholder receives.

Formula Homework 4.xlsx - QUESTION #1 Current Price of Bond Coupon PMT ... View Formula Homework 4.xlsx from FI FI-632 at University of North Alabama. QUESTION #1 Current Price of Bond Coupon PMT+PV of par value PV FV PMT RATE NPER Practice Practice 2 #2 Yield to Maturity. Study Resources. ... Coupon Rate 11.00% Price Maturity (years) 19 Coupon Price % of PAR 108.30% Current Yield NPER 38.00 Rate ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

Bond Yield Calculator | Calculate Bond Returns The bond yield formula needs five inputs: bond price - Price of the bond; face value - Face value of the bond; coupon rate - Annual coupon rate; ... In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest annually.

Coupon Rate Formula & Calculation - Study.com Coupon Rate Formula. The formula for coupon rate is as follows: C = i / p . where: C = coupon rate ; i = annualized interest (or coupon) p = par value of bond ; Coupon Rate Calculation Example

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

Coupon Rate Formula | Simple-Accounting.org For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable for investors than those with lower coupon rates. Bond Yield Rate vs. Coupon Rate: An Overview. Even if the bond price rises or falls in value, the interest ...

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "39 coupon rate bond formula"