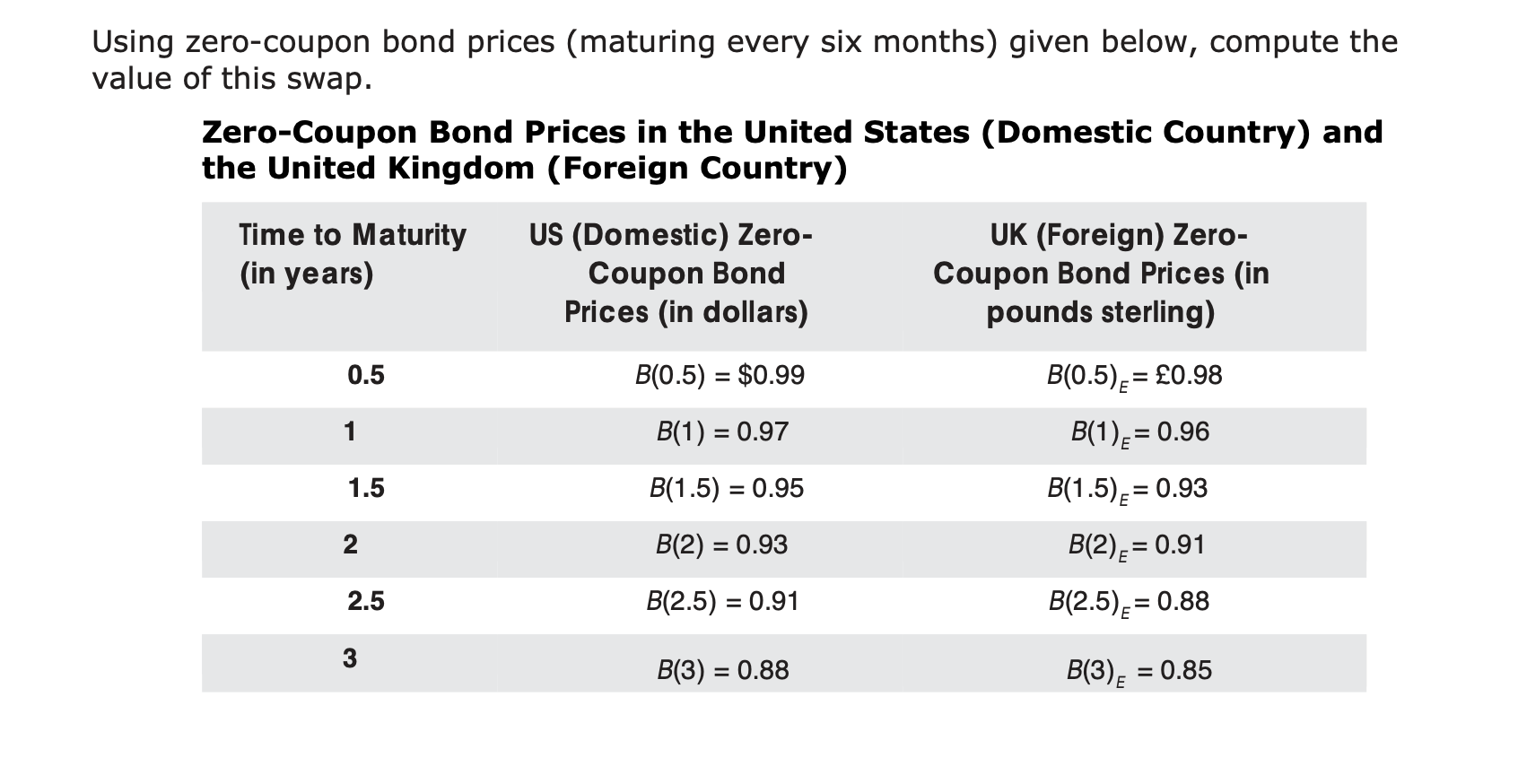

41 value of zero coupon bond

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a ... UCB Investment announces DBH Zero Coupon Bond closure The closing ceremony of DBH Zero Coupon Bond worth Tk 3,000 million was held at a city hotel on Thursday, says a statement. UCB Investment Limited, one of the leading and fast-growing investment banks in the country, is the arranger of this issuance.

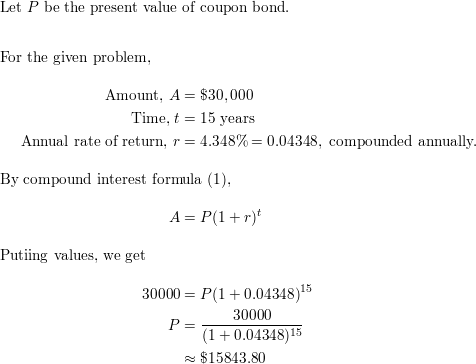

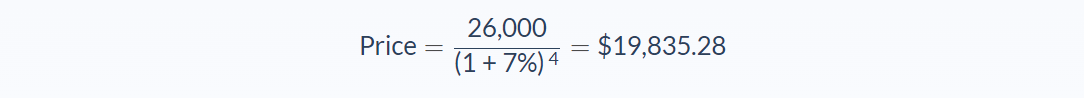

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. The prevailing market ...

Value of zero coupon bond

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 4.243% yield. 10 Years vs 2 Years bond spread is -24.8 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left... SPTI SPDR Portfolio Intermediate Term Treasury ETF - ETF.com The Index includes investment grade Treasurys with a minimum of USD 300 million outstanding face value. It excludes state and local government bonds, TIPS, floating rate bonds, and zero-coupon bonds.

Value of zero coupon bond. African Development Bank offers SA a financing deal to raise $41bn The SPV, which can seek a credit rating, can sell zero-coupon bonds to raise as much as $41bn, Adesina said. ... Top by value and volume. Top 40 Companies. Better Investor Conference 2022. PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded ... - CNBC Get PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (ZROZ:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. EGP T-Bonds EGP T-Bonds Zero Coupon; Deposits (OMO) Fixed Rate Deposits; Variable Rate Deposits; Corridor Linked Deposits; Repo. Fixed Rate Repo; ... EGP Treasury Coupon Bonds Auctions According to the Primary Dealers System. Type Tenor (years) Value (EGP mio) Issue Date Maturity Date Submission Deadline(11 A.M) T.Bonds: 7: 500: 27/09/2022: 05/07/2029 ... PIMCO 25 Year Zero Coupon U.S. Treasury Index Exchange-Traded (ZROZ ... Government Bond ETFs Have One of Their Best Months in Over a Year ETF Trends • Jul 31, 2021 See All News Trending ETFs SPY SPDR S&P 500 $374.3585 -3.0315 0.80% SCHD Schwab US Dividend Equity ETF...

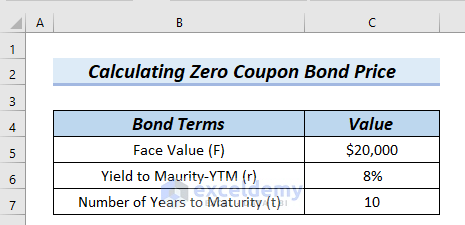

ICE BofA Emerging Markets Corporate Plus Index Effective Yield Each security must also be denominated in USD or Euro with a time to maturity greater than 1 year and have a fixed coupon. For inclusion in the index, investment grade rated bonds of qualifying issuers must have at least 250 million (Euro or USD) in outstanding face value, and below investment grade rated bonds must have at least 100 million ... How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. › terms › pPar Value Definition - Investopedia Jun 22, 2022 · Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. Par ... Russian Government Bond Zero Coupon Yield Curve, Graph Russian Government Bond Zero Coupon Yield Curve, Values (% per annum) Russian Government Bond Zero Coupon Yield Curve, Graph 22.09.2022 Zero Coupon Yield Curve Yield, % p.a 0.25 0.50 0.75 1.00 2.00 3.00 5.00 7.00 10.00 15.00 20.00 30.00 7 8 9 10 11 for 22.09.2022 Was this page useful? Yes No

Coupon Bonds with Changing Interest Rate - ATAR Notes The face value of the bond is $10,000. You observe a yield curve with spot rates that increase 25 basis points for every six month increase in the term of a loan. These rates are nominal, annual quotes. Given that the present value of a $2,000 face value zero-coupon 6-month bond is $1,941.75, what is the price of the 10-year bond? ICE BofA US High Yield Index Total Return Index Value Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify ... Pakistan Government Bonds - Yields Curve The Pakistan 10Y Government Bond has a 13.061% yield. Central Bank Rate is 15.00% (last modification in July 2022). The Pakistan credit rating is B-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 505.92 and implied probability of default is 8.43%. Par Value Definition - Investopedia 22.06.2022 · Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. Par ...

New: , suppose the book value of the debt issue is $70 million. In ... , suppose the book value of the debt issue is $70 million. In addition, the company has a second debt issue on the market, a zero coupon bond with 12 years left to maturity; the book value of this issue is $100 million and the bonds sell for 61 percent of par. What is the company's total book value of debt? The total market value?

› article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity.

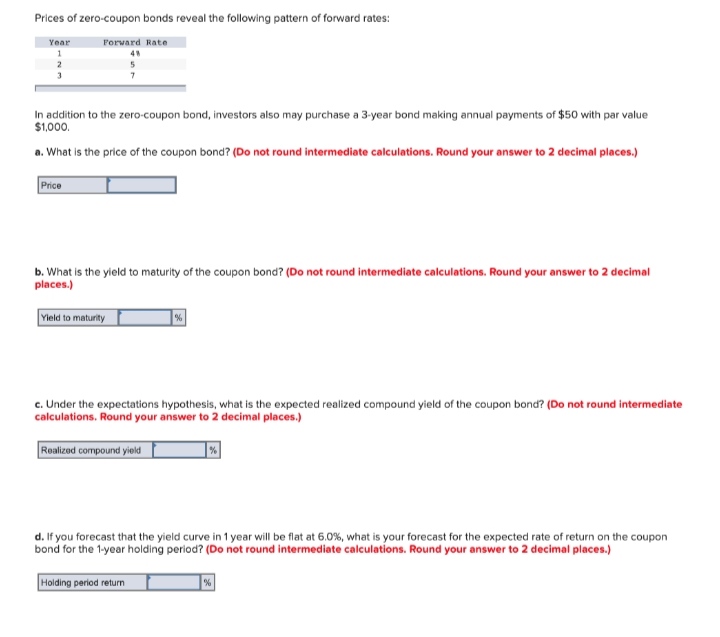

Realized Compound Yield versus Yield to Maturity - Rate Return Future value of first coupon payment with interest earnings $100 X 1.08 = $ 108 Cash payment in second year (final coupon plus par value) $1,100 Total value of investment with reinvested coupons $1,208

What are Bonds? - Ghana Stock Exchange At the end of the bond's tenure or lifetime, the lender then receives a 100 percent of the bond's face value. On the other hand, there are some bonds that do not offer coupon or interest payments (zero-coupon bonds), these are priced at a discounted rate from their face value. When the bond reaches maturity or ends its lifetime, the face ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

How to Invest in Bonds - The Motley Fool The second way to profit from bonds is to sell them at a price that's higher than you initially paid. For example, if you buy $10,000 worth of bonds at face value -- meaning you paid $10,000 -- and...

Key Features of Government Securities - NSE India Treasury bills have maturity of 91 days, 182 days and 365 days Government bonds and State Development Loans pay interest every six months Treasury bills are zero coupon bonds. They are issued by discount and redeemed at face value Advantages of investing in G-sec, SDL and T-bill Safety: Being Sovereign security, no default risk

What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000....

Zero Coupon 2025 Fund | American Century Investments Zero Coupon 2025 Fund - BTTRX SUMMARY PERFORMANCE COMPOSITION MANAGEMENT $105.64 | 0.33% ($0.35) NAV as of 09/02/2022 Historical NAV FUND FACTS Expenses and Dividends Recent Distribution History Historical Distributions Morningstar As of 07/31/2022 Morningstar Rating ™ Investment Objective

Bond Discount - Investopedia 29.05.2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

› zeroZero - definition of zero by The Free Dictionary Define zero. zero synonyms, zero pronunciation, zero translation, English dictionary definition of zero. n. pl. ze·ros or ze·roes 1. The numerical symbol 0; a cipher. 2.

Investing in Bonds Online in India | HDFC Securities In return, the issuer promises to pay a specified rate of interest during the life of the bond. The issuer also repays the face value of the bond when upon maturity of the term. Learn about different types of bonds and find suggestions for best bonds to invest in! Bonds List; ... ZERO-COUPON BONDS These investment bonds are issued at a discount

Yield to Call Calculator | Calculating YTC | InvestingAnswers current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and is callable in 5 years at 103% of face value. Using our YTC calculator, enter: "1,000" as the face value "8" as the annual coupon rate "5" as the years to call

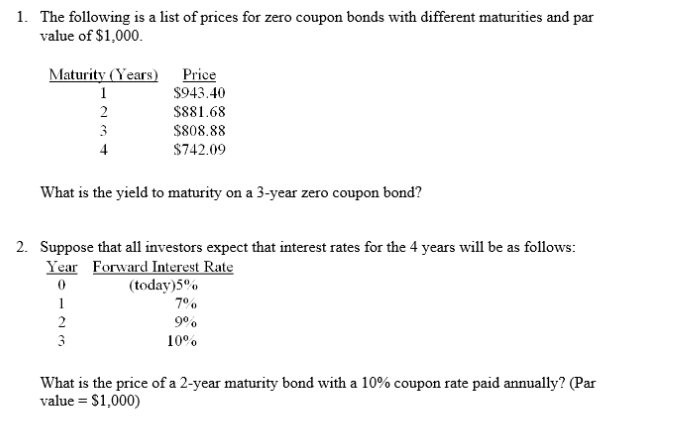

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Zero Coupon Bonds: Calculating Price, Interest, and Value - BrainMass 1) You purchased a zero-coupon bond that has a face value of $1,000, five years to maturity and a yield to maturity of 7.3%. It is one year later and similar bonds are offering a yield to maturity of 8.1%. You will sell the bond now. You have a tax rate of 40% on regular income and 15% on capital gains. Calculate the following for this bond.

EssayRooh Compute the value of the following bonds assuming a 3% discount rate (required rate of return): a. A zero-coupon bond that pays $1,000 in five years b. A bond that pays $1,000 in five years, with five annual coupon payments of $20 each c. What is the coupon rate if coupon payments are $20 per year?

Zero Coupon Bonds: Know tax rules when such a bond is held till ... In bond terms, coupon rate means the rate of interest offered on a bond. As the coupon rate of a zero coupon bond is zero per cent, people investing in such bonds don't get regular interest, but...

EDV Vanguard Extended Duration Treasury ETF - ETF.com The fund has massively long effective duration because zero-coupon bonds carry significantly more interest rate risk than its coupon-bearing counterparts. The fund's holdings are selected through a...

ICE BofA US High Yield Index Option-Adjusted Spread Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date.

GENERAL MOTORS CO.DL-NOTES 2017(17/27) Bond - Insider The General Motors Co.-Bond has a maturity date of 10/1/2027 and offers a coupon of 4.2000%. The payment of the coupon will take place 2.0 times per biannual on the 01.04..

The One-Minute Guide to Zero Coupon Bonds | FINRA.org the value of your zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000 ...

Bond Present Value Calculator Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. If the market rate is greater than the coupon rate, the present value is less than the face value. If it is less than the ...

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years.

Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than …

ICE BofA US High Yield Index Total Return Index Value Graph and download economic data for ICE BofA US High Yield Index Total Return Index Value (BAMLHYH0A0HYM2TRIV) from 1986-08-31 to 2022-09-22 about return, yield, interest rate, interest, rate, indexes, and USA. ... a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities ...

SPTI SPDR Portfolio Intermediate Term Treasury ETF - ETF.com The Index includes investment grade Treasurys with a minimum of USD 300 million outstanding face value. It excludes state and local government bonds, TIPS, floating rate bonds, and zero-coupon bonds.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left...

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 4.243% yield. 10 Years vs 2 Years bond spread is -24.8 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

Post a Comment for "41 value of zero coupon bond"